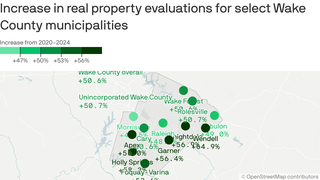

Wake County Property Tax Rate 2024 Based Upon – Erin Davis/Axios VisualsWake County property owners have been getting their new tax appraisals in the mail this past week, and the numbers show an area absolutely soaring in value coming out of the . A Wake County house that matches the average rise in value was worth $165,000 in 2016 with a $991 property tax. In 2020, it went up to $196,000 with a $1,176 property tax In 2024, it would be .

Wake County Property Tax Rate 2024 Based Upon

Source : www.wake.gov

Raleigh Downtown | Raleigh NC

Source : www.facebook.com

Fiscal Year 2024 Adopted Budget | Wake County Government

Source : www.wake.gov

Taylor Anderson Realtor/Owner Avenue Real Estate | Fuquay Varina NC

Source : m.facebook.com

Revenue Neutral Tax Rate | Wake County Government

Source : www.wake.gov

Wake County’s tax evaluations soared in value. Here’s what

Source : www.axios.com

Board of Commissioners | Wake County Government

Source : www.wake.gov

Wake County homeowners brace for property tax adjustments: What to

Source : www.wral.com

New property value notices to hit Wake County mailboxes starting

Source : www.wake.gov

Wake County unanimously passes $1.8 billion budget, property tax

Source : www.wral.com

Wake County Property Tax Rate 2024 Based Upon New property value notices to hit Wake County mailboxes starting : Travis Long tlong@newsobserver.com Home values across Wake County have shot up in the past four years, according to newly released results of the county’s 2024 revaluation. Residential . Homeowners in multiple towns across Wake County could see their property 2024-25 fiscal budget until this summer when the budget process is complete. Based on a revenue-neutral tax rate .